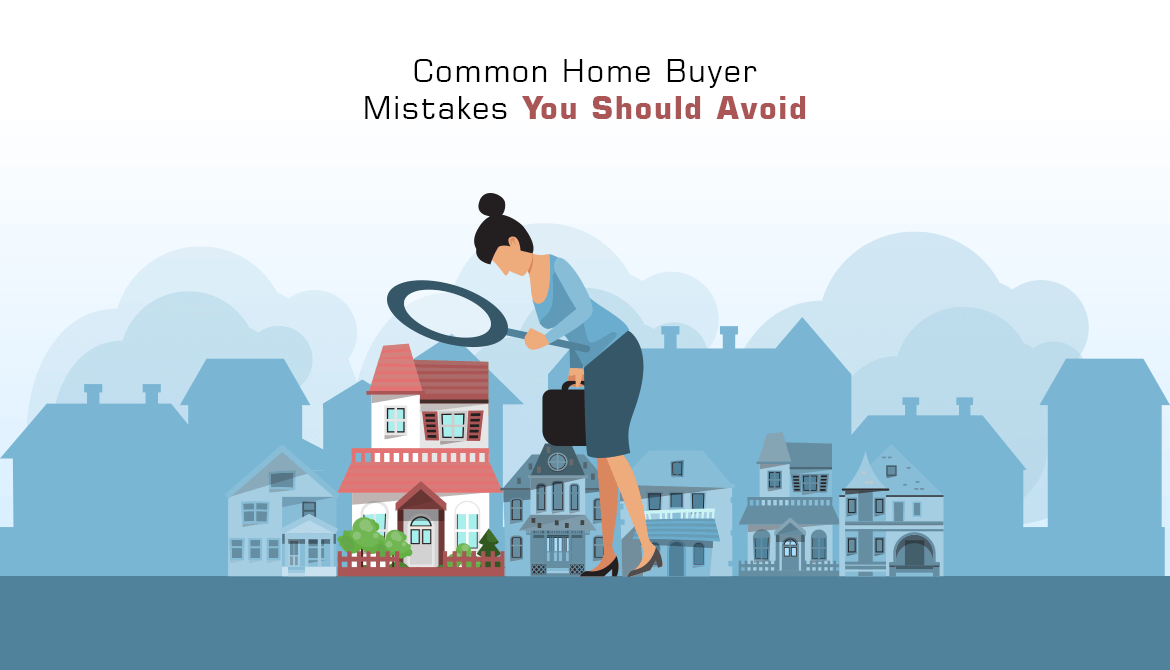

Top Home Buyer Mistakes You Don’t Want To Make

Buying a home is a very important process in everyone’s life. Homeownership has many implications, so it is necessary to keep your emotions aside and make the most rational decision possible. When you finally saved enough to buy your first dream home, check out for various options available before you jump into the real estate market. When you decide to buy your first home, it is not easy to find your preferred neighborhood, find the perfect house, fulfill all your expectations and needs and then finally negotiate the details. Instead of risking your long-term savings and saving yourself from financial stress from poor decision making, read this blog further about how to avoid making these first time home buyers mistakes yourself. Some mistakes are minor ones, some are related to the finances while some can lead you to purchase a property that is completely not the right one for you.

Not researching properly - Before finalizing the deal, you should perform thorough research and be realistic in your search and never settle for anything less and do not cave on important things for sure. Being open to searching out various options will save you from making rash decisions which you might regret later. It’s very true that when you decide to invest in your dream home you might have to compromise on a few things to afford your first home. For example, if you plan to buy a condo apartment just because its cheaper than buying a house than it is definitely not a wise decision. Search for your first homes in many neighborhood areas that might have similar homes constructed by the same builder and settle for one which you have liked.

Not managing your finances - In the event that you accept that you’ll have enough cash to purchase a home since you have the initial down payment. Most importantly, checking your credit score is critical - it can decide the loan fee and insurance costs identified with your new home. What’s more, there are a lot of pre-purchasing costs you probably won’t understand you have to pay for too. The more you can contribute in advance, the simpler the credit procedure will be. However, all through that procedure, in addition to applying for the loan, you additionally need to do things like getting protection for your mortgage holders arrangement set up. You have to read reviews as well.

Not approaching a real estate agent - When you’re searching for a property for yourself, don’t start your search without having a real estate agent. They are the ones who are well versed with all the legal formalities involved to buy a property that is involved in both the seller and the buyer’s side. You should hire a real estate agent who has before worked with your family or your friends or with someone whom you know. The majority of the homebuyers usually buy their first property through a real estate agent.

Underestimating the cost of homeownership - After buying a home, there are many other costs involved which keep stacking up. It is always advisable to be ready for these additional costs like you are going to have a cable bill, telephone bill, gas bill and many other monthly bills which the bank doesn’t care about when qualifying you for a mortgage. There are few renters who don’t mind paying these kinds of bills too. But when you purchase a property the cost could go higher and it might come with entirely new bills such as homeowner association fees.

Neglecting to Inspect the Property - After successfully finding the desired property for yourself and when you’re about to finalize the deal do not forget to inspect the property properly. Before you close on the deal, understand what kind of property you are going to invest your hard-earned money. Obviously, you wouldn’t want to place yourself in a situation where you get stuck with a money pit or with the stress of performing a lot of unexpected repairs. It is necessary to do a proper inspection of the property before you close the deal to avoid making a serious financial mistake.

Approaching only one lender - Homebuyers can easily get a mortgage from the first lender they approach. This can lead them to leave thousands of deals on the table. A good loan officer can help you analyze your situation properly and diagnose any potential roadblocks ahead to give you a clear understanding of your home buying options. The more you research and look around for various options, the better understanding you get making it easier for you to compare, ensuring you’re getting a good deal and the lowest possible rate. Approach a few lenders in your locality as well as mortgage brokers to compare rates, loan terms, and conditions and lenders fees.

Draining your savings - Using all or a large portion of your savings on the upfront installment and shutting costs is one of the greatest first-time home buyer mistakes. A few people figure all their cash out to make a 20 percent down payment so they don’t need to pay for mortgage insurance, yet they are picking an inappropriate toxic substance since they are left without any reserve funds by any means. Homebuyers who put 20 percent or progressively less don’t need to pay for mortgage insurance while getting a traditional home loan. That is generally converted into significant investment funds on the month to month contract installment. Aim to have three to six months of everyday costs in a secret stash. Paying home loan protection isn’t perfect, however exhausting your crisis or retirement reserve funds to make a huge down payment is more dangerous.

Posted on 24th Jan, 2020

|Tags : buy property in Thane, buy apartments in Thane

|Comments : 2 Comments

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

05.02.2022

Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Read More -

21.01.2022

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More