Impact Of Budget On Real Estate

The interim budget 2019 has focused on three main elements that are farmers, the urban middle class and on real estate. Budget 2019 presented by the Government of India has thrown a ray of positive light on the real estate sector this time with many benefits such as tax exemption reforms and an income tax rebate for a second home. This proves that potential home buyers are going to be the biggest winners of this year’s budget. The Government has tried to boost sales of second homes by relaxing the norms for genuine occupiers who already have a home. For self-occupied second homes, consumers do not have to pay tax on rental income. These initiatives are improving end users demand towards real estate, bringing a big relief for developers in between the current demand and liquidity slowdown.

Budget 2019 will help push for affordable housing and infrastructure along with the promotion of rental housing. Budget 2019 has made a number of positive changes for real estate investors.

Tax exemption on rotational rent

The majority of the real estate investors and home purchasers are hesitant to make a second investment for the most part in light of the expense charged on the notional rental pay from their second home. The standard was applicable regardless of whether the residential property was leased or not. But, the interim budget 2019 has rejected this rule by exempting the duty of income tax for notional lease from the secondary self-occupied property. Because of this, the Indian real estate industry is certain to observe a spike in the number of second-time real estate investors.

Section 54 Benefits

Section 54 of the IT act, 1962 allows you to take the benefit of the exemption on long term capital gains tax on the sale of your first property if the proceeds are to be used for the purchase of a new house. If you plan to construct a new house, the construction should be completed within 3 years of the sale of the old house property. Section 54 will only be beneficial if the purchase of a new house is done up to 1 year before or up to 2 years after the previous property is sold. Budget 2019 has permitted the rollover advantage of capital additions u/s 54 and has been expanded from an interest in one residential house to two residential houses if the person has capital gains of up to Rs. 2 crores. Anyway, this advantage is accessible just once in the investor’s lifetime.

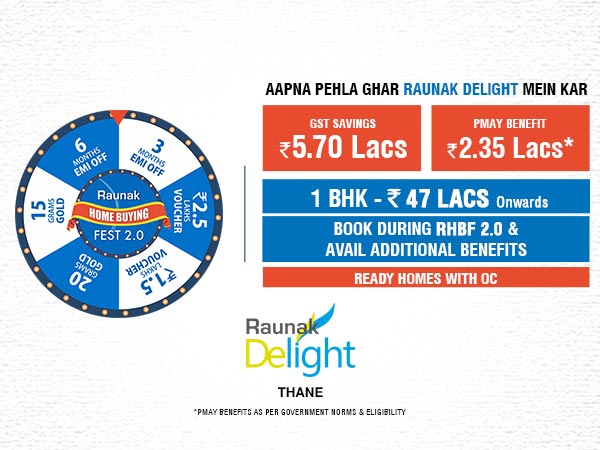

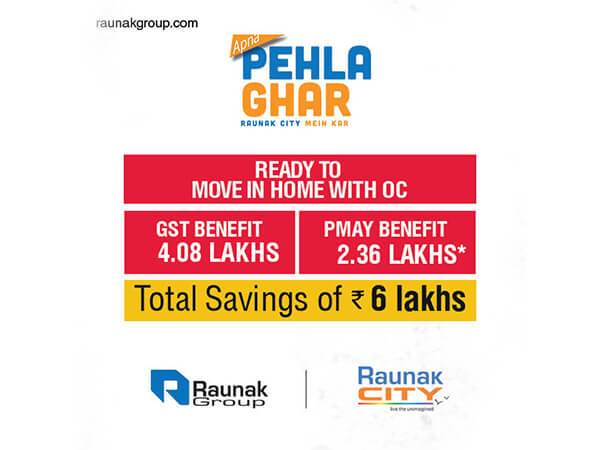

Increased benefits for affordable housing segment

One of the striking features of Budget 2019 is the expansion of Section 80 IBA of the Income Tax by one year. Along these lines, all the lodging ventures affirmed till March 31, 2020, will profit by this expansion. This is an incredible bit of leeway for homebuyers who are searching for affordable home choices. Boosting the affordable housing fragment, thus, makes the Government’s housing for all activity an excellent achievement.

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

05.02.2022

Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Read More -

21.01.2022

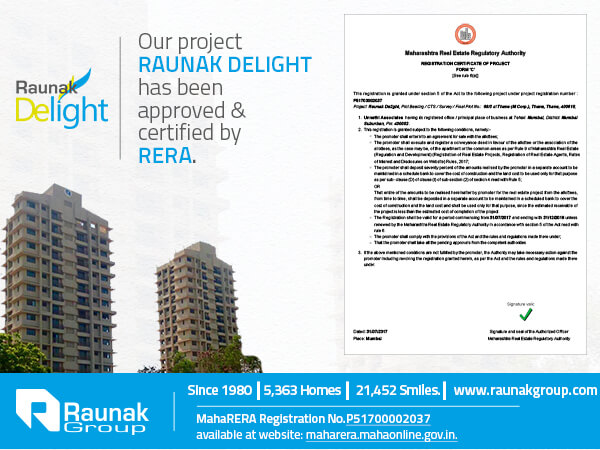

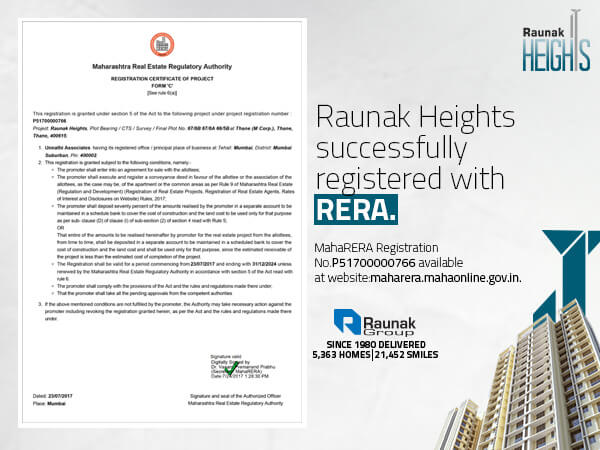

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More