Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Over the past few years, Mumbai has depicted a profound shift. Mumbai is on track to join the ranks of world-famous cities thanks to ongoing improvements to the city`s infrastructure.

Nowadays, investing in Residential Flats In Thane is the most popular form of investment. A considerable amount of investors` portfolios are dedicated to safe and generally non-volatile investment options during periods of uncertainty or volatility, such as the recent pandemic outbreaks.

Real estate has provided all of the above, and will continue to do so, as long as investors take into account many criteria and choose their options intelligently. Although the pandemic has altered our daily routines, real estate investments are here to stay and are expected to increase in popularity.

A Few Pointers That Prove Investing in Residential Flats In Thane During Covid is a Safe Option:

1. Higher Number of Buyers & Investors

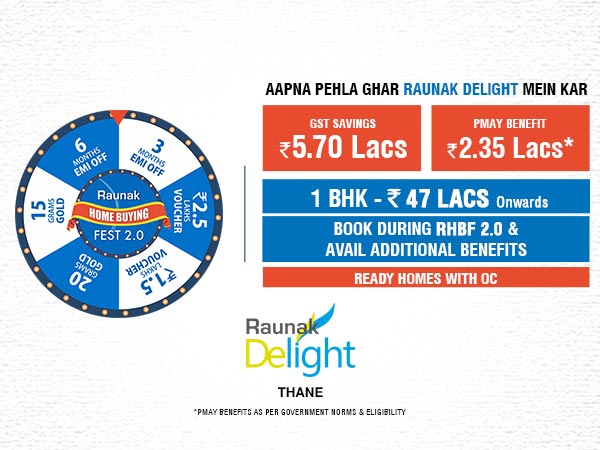

As a result of the COVID-19 economic downturn, stocks have plummeted across the board. Hence, the number of investments has risen due to the low price of property and the ease with which it may be purchased. Furthermore, during COVID-19, the number of people looking to buy a Residential Flats In Thane has not decreased. Rental properties for sale, particularly those that are ready to move in, have been popular with buyers.

Even if the lockdown is lifted in many locations, this tendency will continue for several months. This is because it will take some time for the economy to recover. Interest rates and prices will be kept low after COVID-19 in order to boost consumer demand in the market. With these favourable conditions, real estate investing will be a popular alternative, even more so because of the potential for strong negotiations.

2. Considerable Urban Growth

When it comes to real estate investment, some cities do better than others. This is due to the rapid expansion they experience and attract. As a case in point, Residential Flats In Thane is an excellent example. The sheer quantity of possibilities will keep companies and individuals moving here. The long-term demand for real estate will continue to rise in metropolitan areas since land is scarce and opportunities are expanding. It is apparent from all of the above that real estate will remain a secure investment option during COVID-19.

3. Diversification Of Wealth

Diversification is a critical concept for investors. When investors diversify their investments in Residential Flats In Thane, they lower their overall risk from diverse markets. Following the re-opening of society in a post-pandemic world, real estate opportunities are likely to develop in novel and high-demand manner, resulting in a broader range of investment prospects overall. And, as different cities begin to add a new flavour to their job markets, there is a dynamic panorama of prime property transactions ready to be pursued. With growing diversification in the real estate sector, investors can capitalise on daring and one-of-a-kind real estate deals to boost their earnings.

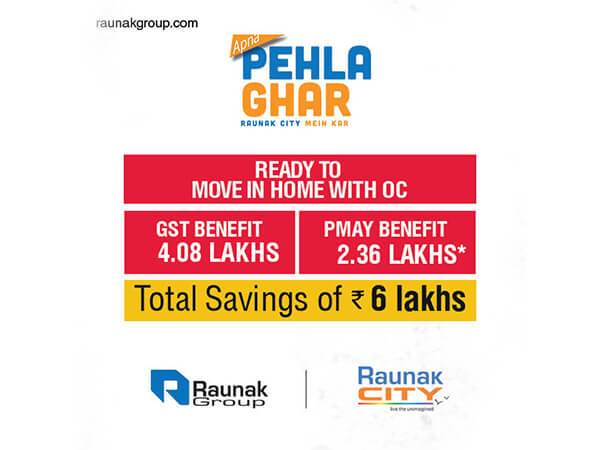

4. Tax Relief

One of the most significant advantages of Residential Flats In Thane is that it provides significant tax breaks on anything from rental homes to apartments to industrial and commercial buildings. Ownership can result in significant tax benefits, including tax sheltering, for many investors. Investors can choose from a variety of tax breaks, including deductions, depreciation, passive income, capital gains taxes instead of income taxes, and more. As different sections of the country have distinct tax break rules, investors should always be completely aware of the benefits that each property provides.

5. The Perks of High Interest Rates

One of the amazing aspects of living in an ongoing-Covid world is that we are currently in the midst of a housing boom. Due to forecasted economic growth, real estate markets are likely to see increased demand for commercial space, as well as improved occupancy rates and property valuations. With growing demand for Residential Flats In Thane, investors with a solid financial foundation have solid prospects to benefit on regional demand.

6. Higher Return On Investment

Buying Residential Flats In Thane is efficient and it can improve an investor`s risk-and-return profile while providing competitive risk-adjusted overall returns. As we`re in the midst of a big property boom, many investment properties are certain to generate some extremely competitive returns for their investors, particularly if they have a high level of population demand.

7. Protection From Inflation

In any market, inflation is something to keep a watch out for. The benefit of real estate investing is that it is a terrific inflation hedge because it has inherent worth, is in limited supply, and is a yielding asset. Residential Flats In Thane are frequently quite appealing to students and young families, owing to the area`s safety, low cost of living, and easy access to resources. The stronger the demand, the more likely the investment will have a solid inflation hedge. It`s just that simple!

NRI Property Investment In India Amid COVID-19

NRIs have traditionally invested in Residential Flats In Thane for rental income. However, the global epidemic has prompted the NRI community to buy property in India. NRIs are actively exploring for investment opportunities in the Indian real estate industry as deposit rates decrease to 6-7 %.

The pandemic has encouraged virtual visits, allowing NRIs to view, select, and invest in real estate online.

According to leading research organisations, NRI investment in Indian real estate is expected to reach $13.3 billion in FY 2021. This is over 6% higher than last year. Due to the second wave and the resulting dread of uncertainty, a part of the NRI community has started selling their existing properties. Although not a nationwide trend, NRI investors in Pune, Mumbai, and Bangalore have decided to stay invested. Moreover, NRI real estate investment in India is estimated to hit $15 billion in FY 2022.

Conclusion: Final Thoughts!

We`ve learned a lot from this pandemic about the importance of staying on top of market trends over the long run. It`s best to find a group of assets that fits your profile, add them to your portfolio, and sit on them when investing in Residential Flats In Thane. In the end, we all know that this pandemic is just a short-term blip. With enough time, even a small amount of money invested now can have a long-term impact on your finances.

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

21.01.2022

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More