Benefits of Adding Your Spouse as a Co-owner When Buying a Home

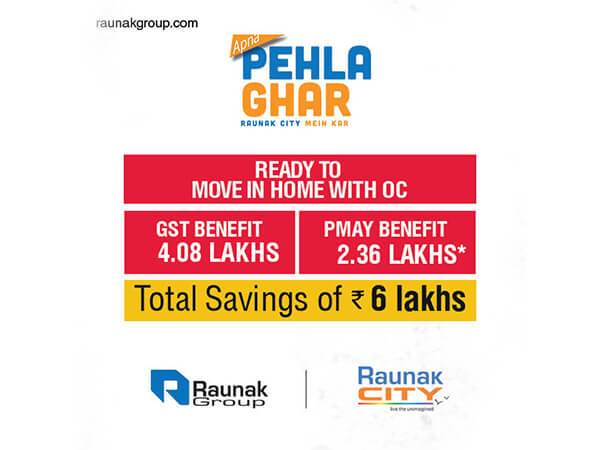

When you are out looking for a property to buy knowing where you buy the property could help you win half the battle. Thane is a perfect spot for you to look for a property to buy. It is very well connected to the city of Mumbai and has all the amenities that Mumbai has on offer but better. You should Buy Property in Thane if you want to have a happy home buying experience. Another big problem that homebuyers buy is how they are going to Buy Property in Thane. To be specific we mean the finances. It is a tough task to Buy Property in Thane because even though the prices are cheaper than Mumbai, the prices are still substantial. One way to get by is to have a co-owner when you take out a loan. Let us look at some benefits of having a co-owner when you Buy Property in Thane.

1. Low stamp duty.

If you are a couple and apply for a co-ownership when you Buy Property in Thane you might be in for some hefty spending. One of the biggest costs after the home is the stamp duty to get the property you bought registered. But what if I told you that you could save some money on your stamp duty? The government gives a relaxation of up to 2% on the stamp duty charges to women to encourage more females to become homeowners in society. Your spouse might help you avail of the lower stamp duty if you apply for co-ownership with your wife.

2. Get a higher loan.

For banks 2 is better than one. If your wife and you are both earning you might want to add your wife as an owner of the flat. Applying for the loan jointly to Buy Property in Thane could help you get more loan sanctioned for you to own the property. This means that the bank could cover all the costs after the minimum down payment you make on the house. A higher approval amount means you could look for a better home to stay in.

3. Tax benefits.

The government of India is encouraging its people to buy homes and as a result, the government of India has announced up to 1.5 lakh deduction in tax if you Buy Property in Thane. A home loan borrower can claim a tax deduction of Rs.1.50 lakh for principal repayment under Sec 80C and Rs.2 lakhs for interest payment under Sec 24. If the property has more than one owner that means both owners can claim the tax benefits. Under the income tax act 80C, each of the joint owners is allowed to avail of a tax benefit of Rs.1.5 lakh for principal repayment. The tax deduction of principal repayment is not the only benefit that can be claimed. Both the property owners can apply for deduction of housing loan interest, up to Rs.2 lakh each.

4. Lower interest rates.

Every bank in India that provides home loans gives some sort of relaxation on the interest rates of the loan. Banks give nearly 0.5% on the interest rates if you add a female co-owner when you Buy Property in Thane. 0.5% sounds small, but over the time of paying interest for the house you bought you could save a fortune in the interests. In a long tenure loan especially when the loan amount is huge you could save a fortune enough to buy you a car for the family for whom you bought the house.

The benefits are immense if you add a co-owner of the property you bought and it would be a regret if you missed the opportunity to avail the offer.

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

05.02.2022

Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Read More -

21.01.2022

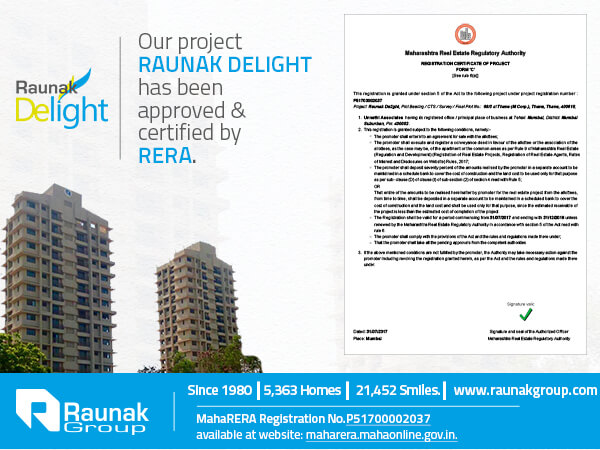

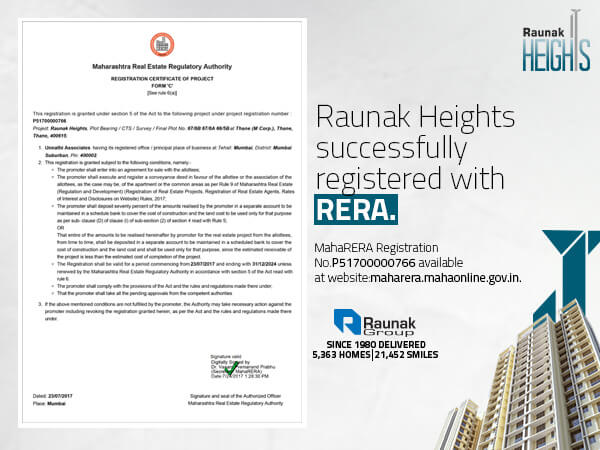

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More