Top Benefits of Investing in Residential Property

Every investment which you might make in your life will have their own advantages and disadvantages. Have you ever thought about investing in real estate? Do you any idea about the benefits of investing in real estate? That is why it is advisable that before you invest in any kind of investment in your life, look for potential experts that will help you throughout the process of investment. With the help of a realtor or an expert in the real estate industry, you will be able to achieve your goals in a better manner. Real estate investment is the acquisition of a future payment stream from the property and can offer various benefits over different kinds of investment, including possibly more significant yields, security, hedging, and enhancement. Numerous people put resources into buying residential property and find that with the correct property and the correct arranging, being a real estate investor can be monetarily fulfilling. At the point when done effectively, real estate is one of the most well-known and productive ventures with a great deal of potential for progress. Real estate investing offers numerous preferences, and speculators can appreciate a consistent payment stream that may lead to financial freedom.

Before you decide to invest your hard-earned cash in buying your first residential property, make sure you conduct a detailed real estate market analysis and seek the help of a real estate professional. Do not depend on any kind of luck, real estate investment is all about studying your potential investment before closing any deal. If you wish to gain profits from investing in real estate, you will have to make wise decisions and calculate your future real estate investment in order to grow. It goes without saying that there are so many benefits of investing in real estate that definitely outweigh the cost. Here are a few benefits of investing in real estate.

Steady Income - People invest in real estate nowadays so that they can give their properties on rent and earn a steady income throughout their life. Depending on the location, you could earn a significant amount to cover all your extra expenses and will also help you earn extra money on the side. This extra income which you get can also help you in reinvesting in more real estate properties. It is important to keep in mind that the cash which you get from the real estate business is predictable and stable compared to various other businesses. If you think wisely and diversify your real estate investment portfolio, you can invest in multiple properties at once and increase your cash flow. Just remember that location is the prime factor for positive cash flow and is considered to be the key to smart real estate investing. Always choose a prime location to get maximum benefits of investing in residential real estate. The majority of the entrepreneurs prefer investing in real estate after experiencing the ups and downs they face in other types of businesses.

Appreciation - On the off chance that you as of now you are planning for a real estate investment or are simply beginning, you do comprehend that real estate is certifiably not a short term plan. In actuality, the advantages of putting resources into real estate incorporates the energy about capital resources (otherwise known as land) after some time. As such, your property’s estimation will be way more quite a while from now, hence why investors are in it for a long time run. The main reason being is that rental rates are increasing to rise due to the interest in these facilities and expanding development costs. Also, with the number of investors bidding on residential real estate, the cap rate, or yield, is continuing to compress, which is thereby further increasing the values of the real estate.

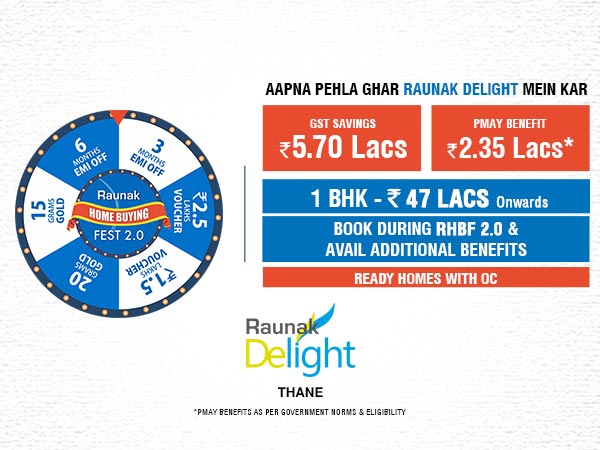

Tax Advantages - One of the biggest benefits which you can avail after investing in residential real estate is the tax exemptions that the investors can get from owning a rental property. This is a major reason why many people choose to invest in real estate. For example, the rental income you receive is not subjected to any self-employment tax. The government also offers tax breaks for property depreciation, travel expenses, legal fees, property taxes, and insurance. It is therefore important to understand that real estate investors are subjected to lower rates. Be careful as different people might encounter different tax situations so be very sure or you can consult a tax professional regarding any queries for your personal finance pictures.

Inflation Hedging - Inflation is characterized as a continued increase in the general degree of costs for goods and services. As such, it causes each dollar you claim to purchase a little level of a good or service over time. Stocks, for example, require more cash to buy with the increase in inflation. Basically, inflation keeps your cash from going to the extent that it would have. Real estate, on the other hand, fills in as a hedge against inflation. In contrast to pretty much every other type of venture, real estate responds proportionately to inflation. As inflation increases, so do leases and home values. As economies expand, the interest for real estate drives rents higher and this, thusly, converts into higher capital qualities. In this manner, real estate will, in general, keep up the buying intensity of capital bypassing a portion of the inflationary weight on to occupants and by consolidating a portion of the inflationary weight as capital appreciation.

Posted on 3rd Jan, 2020

|Tags : buy property in Thane, buy apartments in Thane

|Comments : 2 Comments

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

05.02.2022

Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Read More -

21.01.2022

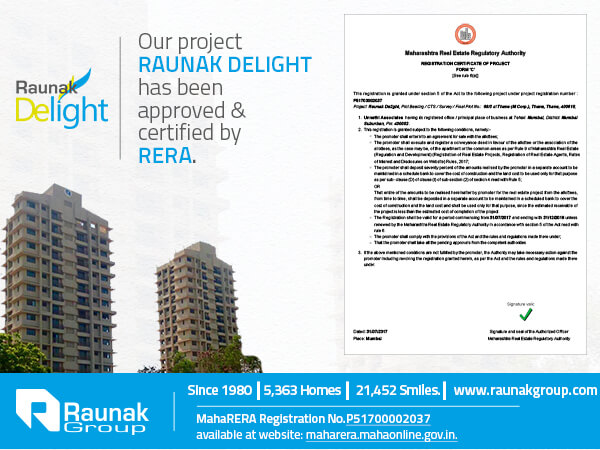

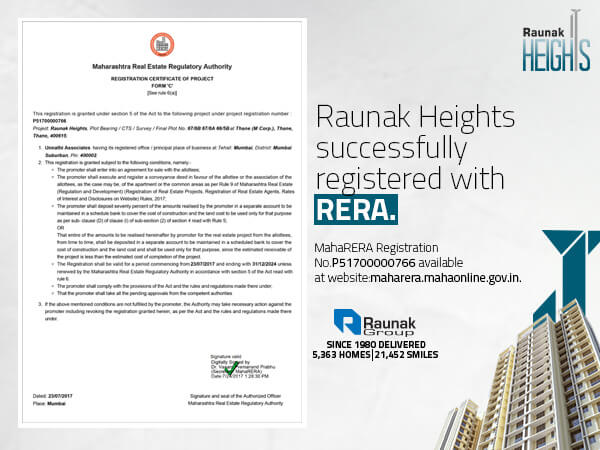

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More