Why Is There A Sudden Upsurge Of NRI Investments In Properties In Thane?

Global Indians contribute to Indian forex reserves through investments in various Indian assets classes, of which it is witnessed that real estate investment forms a major chunk out of it. NRIs, too, have always had a positive experience in investing in real estate. Real estate investment has always been Indians’ favourite asset class, including those who stay abroad. NRIs are eligible to take loans and invest in the real estate market. However, the only criteria which are to be followed are they have to pay back their loan in Indian currency only. The Indian real estate market has witnessed 10-15 percent growth in the property enquiries and transactions done by NRIs in the past few years. Buying a property in the home country helps NRIs to connect with their roots and also assures steady Returns on Investment (ROI) in comparison to other asset classes like buying gold or investing their money in the stock market. The positive impact of various reformatory changes imposed by the government in the real estate industry moving towards greater transparency, efficiency and accountability helping NRIs to take a step forward in buying a property in Thane.

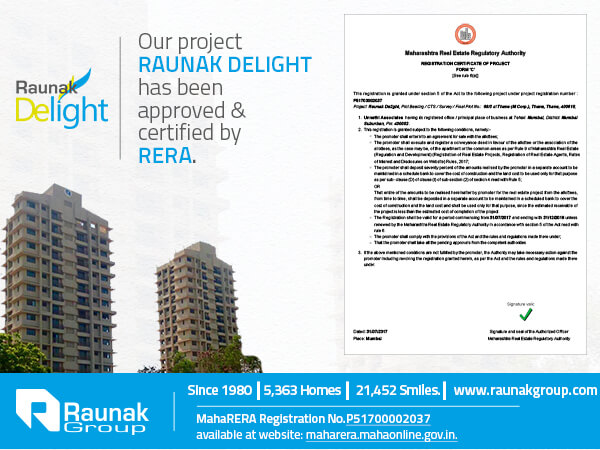

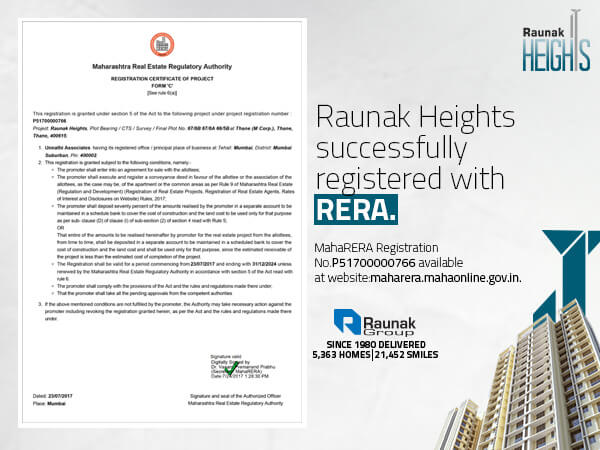

Investing in real estate is no longer a challenging task for NRIs as it used to be earlier. The recent regulatory changes have made the real estate sector more efficient and transparent for everyone helping more NRIs to invest in properties in Thane or elsewhere. It is necessary to have a checklist of things before an NRI plans to invest that is all important documents, KYC, Payment plan, tax implication legalities and other formalities and a very important thing is someone who is trustworthy to help NRIs to facilitate the entire process so that it is smooth without any difficulties. Real estate transactions for NRIs fall under the purview of Foreign Exchange Management Act (FEMA). NRIs holding an Indian passport need no approval according to the Reserve Bank of India when they are investing in Indian real estate. According to the Indian laws, any property investment done by NRIs will include stamp duty, registration charges and service tax to be paid accordingly. NRIs are liable to purchase any number of properties as well as any kind of properties from residential to commercial to farmhouse or agricultural land as long as they follow all the reforms and rules in the Indian realty market.

Many individuals from Mumbai and different parts of Maharashtra are taking a gander at Thane as a superior open door as a result of better infrastructure, schools and job opportunities. Likewise, it will be associated with the metro, which will decrease a lot of travelling time between the two urban areas. From an affordability perspective, a 2 BHK flat in Thane begins from 70-80 lakhs yet in Mumbai it costs at the very least 1.5-2 crores. Navi Mumbai is robust in comparison with Mumbai. We do see the gratefulness in costs in the following years. When the upcoming proposed projects are done, speculators will naturally get a 5 to 10 percent hike from current costs. The metro will be operational in a couple of years and will take the real estate sector to another level. Some of the renowned developers are working in Thane so the capability of this spot is also increasing. Normal capital return in the most recent year in Thane was 10-15 percent. We see great footing there in light of the affordability factor. NRIs visiting these residential projects are searching more for both ventures just as close to personal use.

Posted on 24th Apr, 2020

|Tags : buy property in Thane, buy apartments in Thane, buy luxury flats in Thane

|Comments : 2 Comments

-

03.03.2022

Why Buying Residential Properties in Thane is The Safest Future Real Estate Investment Bet?

Read More -

18.02.2022

A Detailed Guide For NRIs Who Want To Invest In Under Construction Projects In Thane

Read More -

05.02.2022

Here's Why Buying Luxurious Flats In Thane Will Remain a Safe Investment Choice Despite COVID-19 Scare

Read More -

21.01.2022

What is RERA & Why is it Important To Opt for RERA Registered Upcoming Residential Projects in Thane?

Read More -

31.12.2021

Extra Expenses That One Must Consider When Planning To Invest In 2 BHK Flats In Thane

Read More -

11.12.2021

Why Are Under Construction Projects In Thane Your Best Choice Of Property To Buy At This Point?

Read More -

26.11.2021

Home Loan Rates At Their Lowest - Why This Is The Perfect Time To Buy A Property In Thane?

Read More -

26.11.2021

Advantages of Investing In New Residential Projects in Thane While They are Still in their `New Launch` Phase

Read More -

12.11.2021

5 Things To Look For In a Flat When Buying Residential Property in Thane in the Post COVID Era

Read More -

29.11.2021

Secrets That First Time Home Buyers Need To Know When Investing In Properties In Thane

Read More -

22.10.2021

Top 15 Key Terms From Today's Housing Market To Understand The Trends When Planning To Buy Flats In Thane

Read More -

16.10.2021

With Rental Rates On The Rise, Is It The Time To Invest in New Residential Projects in Thane?

Read More -

01.10.2021

7 Things That You Can Do To Be A Proud Owner Of A Residential Property In Thane

Read More -

24.09.2021

How Much Does It Cost To Buy A 1 BHK Flat In Thane? What Are The Hidden Charges?

Read More -

03.09.2021

Important Factors To Decide The Best Area To Buy A Residential Property In Thane

Read More -

20.08.2021

Coronavirus Unlock: Is Now A Good Time To Invest In Residential Flats In Thane?

Read More -

13.08.2021

Hacks To Make Your Personality Reflect In Your Residential Flats In Thane To Present Your Unique Self

Read More -

30.07.2021

What happens to a residential property in Thane whose owner passes away without a will?

Read More -

26.07.2021

Top 10 Tips to assist you with the decision of what floor to buy a Residential Property in Thane Ghodbunder Road

Read More -

11.06.2021

Real Estate Investors View Residential Projects In Thane As Big Opportunities Post-Covid

Read More -

16.04.2021

Experience The Symphony Of A Readymade Life By Investing In A Ready To Move Flat In Thane

Read More -

09.04.2021

Prices of Affordable Housing Properties in Thane Expected To Shoot Up-Post Lockdown Impacts

Read More -

20.03.2021

Things You Must Check-Off On Your Checklist While Looking For Flats For Sale In Thane Near Station

Read More -

05.03.2021

Looking To Buy A Flat In Pokhran Road On Single Income - This Is How You Do It!

Read More -

10.04.2020

How Investing In A Residential Property In Thane Can Put An End To Your Commuting Woes.

Read More -

14.12.2019

How Hard Is It To Find the Right Balance Between Luxury & Affordable Flats in Thane

Read More -

22.10.2019

The Essential Checklist To Consider Before Investing in Any New Building Projects in Thane.

Read More